Financial Planning...It Starts With YOU

Managing Your Wealth Often Times Involves More Questions Than Answers

- What happens if there is a major market correction?

- Am I at risk for outliving my money?

- Am I taking too much risk with my current portfolio?

- How can I minimize by tax liabilities?

- How can I retain more of my earnings?

- Am I adequately diversified to minimize risk?

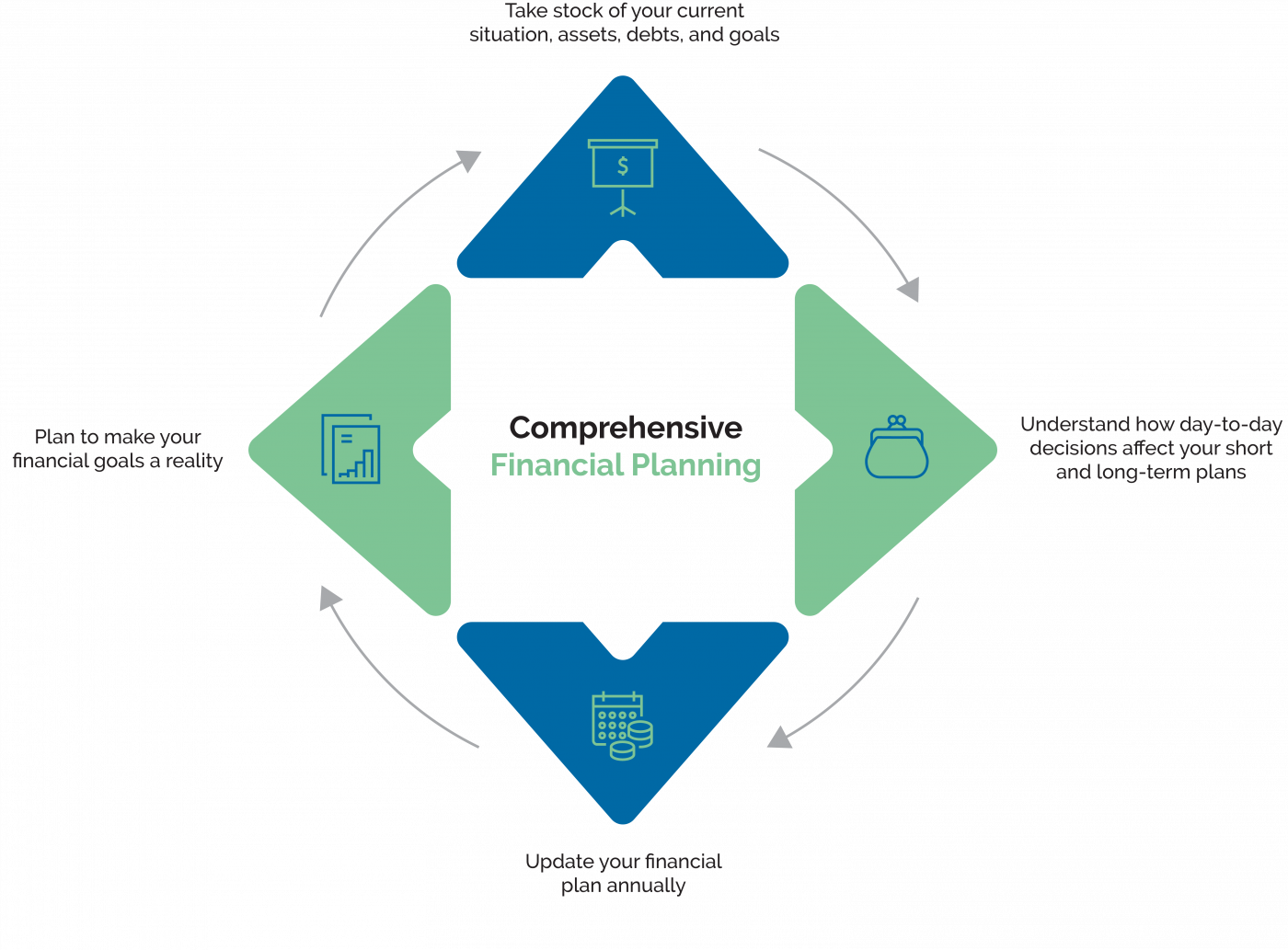

The VIAWealth Process

Our comprehensive advice and services take into account a full accounting of your current financial situation, including your assets, debts, and goals. When you look at your entire financial life, you gain a deeper perspective of your financial goals and what type of plan you need in order to potentially make those goals a reality.

Your Wealth. Your Life. Your Journey.

We also look into your everyday habits and financial biases to get a better understanding of how these might impact both your short and long-term wealth. Understanding your behaviors can help you evaluate both the positive and negative patterns in your financial life. When you deploy fact-based decisions into your everyday life vs. emotion-based decisions, you are positioning yourself and your family for a successful financial life.

Tax planning is another important component of our financial planning process. This is especially important with pending income tax changes that may impact your overall financial plan and investment strategy. We’ll work with you to create a strategy that protects your investments along with limiting any income tax consequences.

You should always be prepared for life's detours, which our financial planning process accounts for.

Complimentary eBook:

10 Bad Money Habits Affluent Investors Should Avoid in a Down Market

If you have savings of $500,000 or more, it’s essential to make intelligent, informed financial decisions about managing your money when the market is down or volatile.

Download Now