Returning to Normalcy

In 2022 US stocks fell 18% measured by the S&P 500 and the US bond market dropped a spectacular 15% measured by the Aggregate Bond Index, AGG, reflecting the entire US investment grade bond market. The year also marked the end of aggressive monetary policies that pushed asset values to extreme levels as investors sought out increasingly speculative investments and higher returns. US stock valuations are now down to a more normal 17 times 2023 expected earnings, while bond yields have risen to much more attractive and typical levels. In a phrase, the roosters came home to roost. We believed it could not last, and in 2022, it didn’t.

If we shift the perspective to a two-year period ended 12/31/2022, US large cap stocks gained 5.4%, measured by the S&P 500. This represents over 92% of the US stock market. Over the past two years investors in US stocks have had positive results. The returns of 2021 were the anomaly, not 2022. US corporate profit growth has continued to be strong and dominates the global economy.

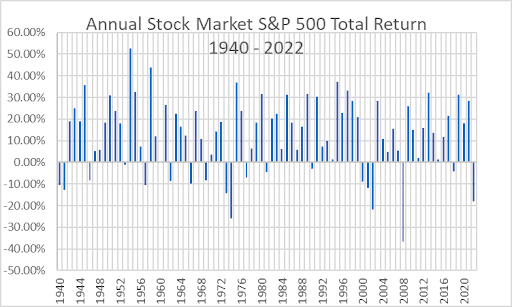

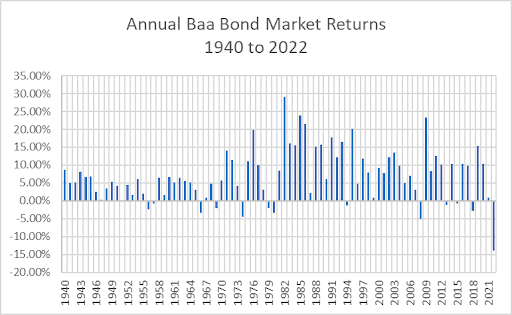

As viewed in the charts below, the 18% drop in the S&P 500 was meaningful but was at a level we have seen several times since 1940. The bond market was the clear outlier. Investment grade bonds show a negative annual return on a scale not experienced since 1940. * This reflects the return to normalcy of the Federal Reserve and its monetary policy after years of ultra-low rates.

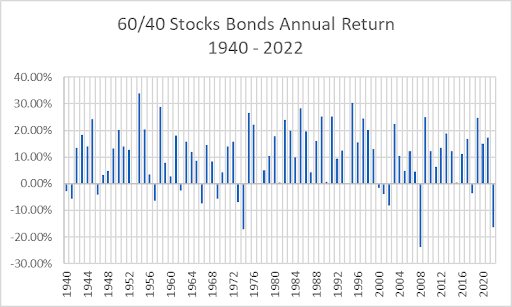

The diversification benefits from adding bonds to a stock portfolio typically has had a significant reduction in the one-year volatility. That did not happen in 2022. A theoretical 60% stock, 40% bond portfolio experienced the biggest drop since the financial crises of 2008 and one of the three worst years since 1940.

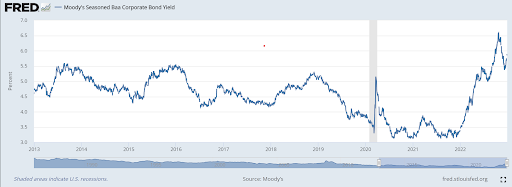

Current yields in investment grade corporate bonds have risen to much more attractive levels as displayed in the graph below. These higher yields will help limit the excessive valuation levels of other investments and again allow the dampening diversification benefits from bonds during the next financial market cycle.

Conclusions

- Free money can’t last. In 2022 it came to an end. Be wary of further fallout.

- Do not give up on a diversified portfolio including bonds. A 60/40 mix of stocks and bonds did not work to significantly mitigate losses in 2022. This does not mean it will not work in the future. Current yields indicate that it should work next time. The best advice remains a well-diversified investment portfolio incorporating bonds to lower volatility.

- Maintain an underweight to stocks. Bonds now provide a more attractive alternative to stocks on a relative basis. Until inflation is contained, stocks will be challenged by restrictive monetary policy. Valuation levels have fallen but remain above average on several metrics. Be cautious about adding to stocks on weakness. Slaying the inflation dragon will take time and may likely require more than the arsenal of the Federal Reserve.