Higher Inflation Hurts Financial Markets

Financial Market Commentary, July 2022

High or rising inflation creates a significant challenge for many financial assets. With the spike in inflation during the first half of 2022 we witnessed a 20% decline in stocks measured by the S&P500, a 10% decline in bonds, measured by the US Aggregate bond index, and longer duration corporate bonds falling closer to 15%. Inflation hurts fixed income investments because higher inflation typically leads to higher yields, thus lower prices for bonds. Inflation hurts stocks by lowering the valuation multiple due to the higher discount rate required for future cash earnings.

Perspective

The significant spike in inflation is very apparent in the chart below. It is the most important metric of 2022.

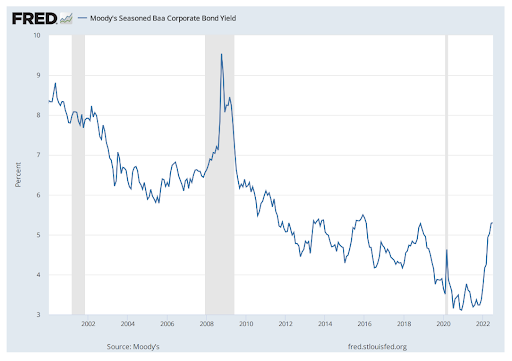

Prices for bonds were pushed down to increase their yields as shown by the sharp rise in corporate bond yields in the chart below. The net result was the 10% drop in the bond US Aggregate bond index.

Stocks prices are typically set by the product of two inputs, the earnings per share multiplied by the Price to Earnings or PE valuation ratio. Earnings have grown nicely as depicted in the chart below. The chart plots the actual historical earnings plus the expected earnings per share for 2022 and 2023 for the S&P500. It shows earnings reached a record in 2021 with future higher expectations in 2022 and 2023.

There exists an inverse relationship between interest rates and the PE valuation ratio. If interest rates go up, the PE goes down. The graph below shows how the PE valuation multiple has dropped with the rise in interest rates during 2022. The net result has been lower stock prices because the positive impact from higher earnings has been overwhelmed by the significant drop in the PE valuation ratio.

Looking Ahead

The good news is that current stock prices reflect a PE valuation ratio of about sixteen times expected 2022 earnings. This valuation metric is 27% below the 22 PE during 2021 and is consistent with 2014 – 2017, an era when corporate bonds yields were similar to today’s levels. Stocks will start to act better when investors believe inflation can come back down to the 2% – 2.5% level and when markets believe corporate earnings can continue to grow in 2022 and 2023 and beyond.

If inflation persists above 3.5%-4.0% and corporate earnings plateau or decline, both the stock market and the bond market will continue to face significant headwinds. PE multiples would likely fall further, and interest rates would rise. At ViaWealth we believe stocks and bonds are less risky than one year ago given the significantly lower valuation level and higher yields. Continue to be patient, maintain diversified investment portfolios, and understand that the financial markets are always looking well into the future.